UNVEILING THE HIDDEN COSTS OF FAILED PAYMENTS

For businesses that operate on a subscription or recurring billing model, the lifeblood of their success hinges on acquiring and, most crucially, retaining customers. While acquiring new customers is essential, retaining them is what truly drives consistent revenue growth and long-term profitability. This is because the longer a customer remains subscribed, the more likely it is that the business can recoup the Cost of Goods Sold (COGS) and the often substantial customer acquisition costs (CAC).

The core principle is straightforward: extending customer tenure translates directly into enhanced revenue growth and greater profitability for subscription-based businesses. The critical nature of this relationship makes it imperative for these businesses to thoroughly understand and effectively manage all factors contributing to customer churn. By minimizing churn, businesses can significantly improve key performance indicators (KPIs) and optimize their overall growth trajectory.

THE ROOT CAUSES OF CUSTOMER CHURN IN SUBSCRIPTION BUSINESSES

Customer churn represents a formidable challenge for subscription businesses. Every churned customer not only means a loss in revenue but also the loss of potential future revenue streams from subsequent billing cycles. While most causes of churn are well-documented and actively managed, including:

- Customer Fatigue: The customer may feel the product or service no longer provides value, leading to the decision to end the subscription.

- Competitive Loss: The customer finds a better alternative or a more affordable option and decides to switch providers.

- Customer Service Issues: Negative experiences with the product, service, or brand can prompt the customer to cancel or not renew their subscription.

What many businesses may overlook, however, is that up to 48% of subscription-related customer churn does not stem from customers voluntarily canceling their subscriptions. Instead, it is driven by failed credit card payments.

Even more alarming is that a significant portion of these failed payments is not due to insufficient funds or fraud detection systems flagging suspicious activity. Rather, legitimate transactions are often declined by the payment authorization system, leaving customers who are ready and willing to pay unable to complete their purchases. To explore the complexities and limitations of the payment system that lead to these "false declines," also known as credit card authorization declines on legitimate transactions, you can refer to the Payments Authorization Management blog post.

UNDERSTANDING THE FULL ECONOMIC IMPACT OF FAILED PAYMENTS

The direct link between failed payments and customer churn is often underestimated, yet it is critical to understand the full economic impact of these failed payments. There are two main ways that failed payments contribute to churn:

Direct Impact: Each failed payment that is not recovered results in a lost customer, leading to a direct and measurable impact on revenue.

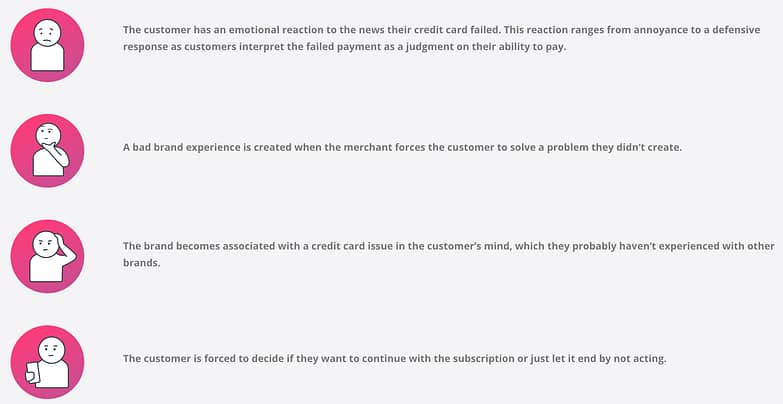

Indirect Impact: When customers are made aware of a failed payment—either through interrupted service delivery or through customer service outreach and dunning methods—they may be prompted to reassess their commitment to the service. This awareness can lead to a higher likelihood of churn, as customers may feel inconvenienced or frustrated by the need to resolve the payment issue themselves.

The not-so-obvious impact is particularly insidious: asking customers to help fix a failed payment can inadvertently contribute to churn. When a customer is asked to intervene in resolving a payment issue, their typical reactions might include frustration, inconvenience, or even a loss of trust in the service provider.

QUANTIFYING THE COST OF FAILED PAYMENTS

Once the connection between failed payments and customer churn is fully understood, it becomes clear that the cost of these failed payments extends far beyond the immediate lost revenue. The total economic cost must be calculated by considering the revenue lost from all future payments the customer would have made if their subscription had continued. This comprehensive cost calculation reveals the true impact of a lost customer, which is far greater than the cost of a single declined payment.

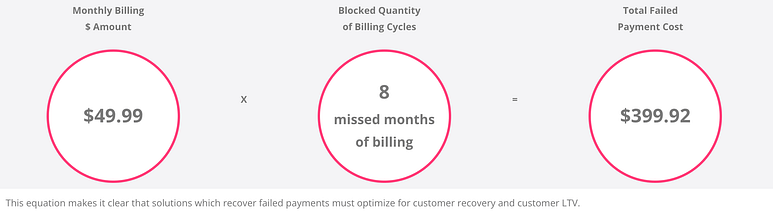

The formula used to calculate Customer Lifetime Value (LTV) can be adapted to quantify the cost of losing a customer due to a failed payment:

Monthly Billing $ Amount x Blocked Quantity of Billing Cycles = Total Failed Payment Cost

For instance, consider a subscription company with a customer who is billed $49.99 per month. If this customer experiences a failed payment in their third month, and the average customer lifespan for the company is 10 months, the cost of losing this customer would be significant.

CALCULATING THE VALUE OF A RECOVERED CUSTOMER

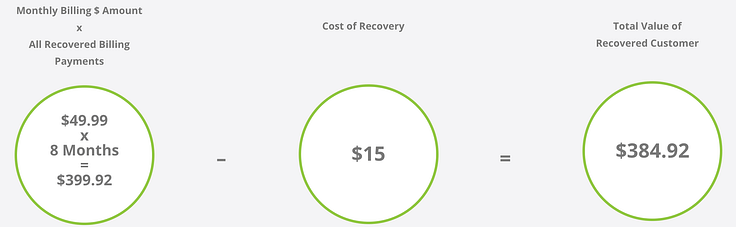

Similarly, the formula can be applied to determine the value of a customer who is successfully recovered after a failed payment. Using the same example, if the customer is recovered and continues their subscription, the company not only recovers the immediate lost revenue but also gains the benefit of all future billing cycles.

The calculation of the full value of a recovered customer must include both the recovered payment and the ongoing revenue generated from subsequent billing cycles. This comprehensive approach to measuring the value of recovery leads to two crucial insights:

Optimization of Recovery Solutions: Failed payment recovery solutions should be optimized to not only recover lost revenue but also to retain customers and extend their lifespan post-recovery.

Prioritization of Effective Solutions: Businesses must prioritize the implementation of recovery solutions that maximize the length of customer retention following recovery, thereby maximizing the overall LTV.

FINAL THOUGHTS: MAXIMIZING THE VALUE OF SUBSCRIPTION CUSTOMERS

For subscription-based businesses, the deployment of an effective recovery solution is not just about recapturing lost revenue—it’s about retaining customers and maximizing their long-term value. By investing in a solution that not only recovers failed payments but also extends customer retention, businesses can significantly enhance their profitability and long-term growth potential. Prioritizing recovery solutions that deliver the highest customer retention rates post-recovery is essential to achieving this goal. The true value of recovered customers lies not just in the immediate revenue recovered, but in the ongoing contributions they make to the business over their extended lifecycle.

Is your business experiencing failed recurring payments? Contact us today to explore solutions that will recover up to 80% of your failed recurring payments, increasing your cash flow and profitability.