Subscription companies must prioritize being customer-centric, as the unique relationship their customers have entrusted to them requires it. Unlike one-time transactions, subscription customers commit to an ongoing relationship by regularly paying for products or services, reflecting a deeper level of trust and perceived value.

Introduction

The cost of acquiring a subscription customer can vary widely across companies, but often the investment to secure a new subscriber surpasses 2.5 months of billing revenue. Enhancing customer satisfaction and loyalty, and consequently retention, has a direct positive impact on crucial financial metrics such as revenue and profitability. This direct relationship between customer loyalty and the overall health of subscription businesses underscores the need for companies to prioritize customer obsession.

Interestingly, subscription businesses typically have fewer natural interaction points with their customers compared to transactional merchants. When you consider it, there are only three key moments where subscription customers engage with the brand, influencing their subscription decisions. These touchpoints include:

- The product or service experience itself.

- The customer support experience (when necessary).

- The payments experience (which customers perceive as either seamless or frustrating).

Subscription companies understand the connection between customer experience and loyalty and retention, dedicating significant resources to optimizing both the product and support experiences.

However, many subscription companies overlook the payments experience as the third critical pillar of the customer relationship, which plays a pivotal role in driving satisfaction and retention.

This oversight often leads to the payments tech stack being treated merely as an operational tool, focused on managing customer accounts, connecting to the payments system, and collecting revenue. In reality, the payments tech stack should also be designed to deliver optimal customer experiences, especially when issues arise within the payment system.

The Legacy Payments Tech Stack

The traditional payments tech stack is structured to manage ongoing customer billing and facilitate the connection between active customer accounts and the card payments ecosystem.

Here is a simplified overview of the legacy payments tech stack, highlighting its two core components:

- The billing or CRM system: This system stores customer information and triggers billing transactions. It typically houses customer account details, credit card numbers, and billing information, such as how much to bill, when to bill, and the service level. Billing systems can be hosted by third-party providers like Maxio, Direct Scale, or Zuora, or can be custom-built in-house.

- The payment gateway: This component enables companies to submit credit payment requests to issuing banks and manages payment settlements back into merchant accounts.

Defining an Ideal Payment Experience

For subscription customers, the ideal payment experience is one that is completely frictionless, with payments being processed seamlessly. In this scenario, customers make their payments and continue to receive products or services without any interruptions.

While the legacy payments tech stack can provide this experience, it is only possible if there is no existing friction within the payment system.

Understanding a Poor Payment Experience

A negative payment experience occurs when card payment requests are declined, often leading directly to customer churn.

Unfortunately, the payment system itself can create friction within the subscription payment process, usually without any fault on the part of the customer or business. This friction typically manifests as failed payments, which result from declined customer card transactions. Declines can occur at any point during the subscription relationship, whether it’s the first payment or a subsequent one.

These declines often happen because banks categorize recurring subscription payments as higher-risk transactions with an increased likelihood of fraud. False declines, where legitimate transactions are mistakenly flagged as fraudulent, occur surprisingly frequently—up to 24% of the time for recurring payment submissions. Other reasons for declines include expired cards, canceled cards, NSF, and various other factors.

The legacy subscription payments stack lacks the capability to recover failed payments or to prevent the negative experiences and customer losses caused by these failures. Some more advanced companies have identified the high cost of failed payments and have developed internal retry systems or customer collection processes. However, these solutions are merely temporary fixes that offer limited help and fail to deliver a great customer experience when the payment system is the root of the problem. They do not fully address the failed payments issue or the resulting churn.

Achieving Best-in-Class Payment Experiences

An ideal payment experience for a subscription customer is one that is seamless, where transactions are completed without the customer even realizing a problem occurred. The ideal scenario following a failed payment is one where the issue is resolved quickly within the payment system, without requiring any customer involvement. From the customer's perspective, everything continues as normal, and churn is entirely avoided.

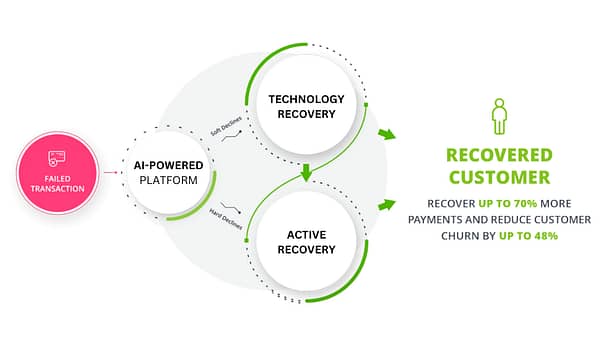

A simple way to deliver this flawless customer experience is by utilizing an AI-Powered platform, an AI-driven solution that works directly with the payment system to recover failed payments. The platform’s machine learning models generate unique recovery strategies for each failed payment, optimizing key variables such as the issuing bank that declined the payment, the reason for the failure, the type of card used, and other factors. A technology recovery process ensures that failed payments are quickly recovered, preventing customer awareness of any issues, and ensuring that the subscription service continues uninterrupted.

Handling Customer Involvement in Failed Payments

Of course, some failed payments will necessitate customer involvement to resolve. Subscription companies must be as committed to delivering an excellent customer experience in these situations as they are when using a technology recovery process. Remember, a moment of truth is created in the customer relationship when the customer is informed of a failed payment and asked to help resolve the issue. This moment provides the customer with the choice to either resolve the issue or end the subscription relationship.

Subscription businesses should approach payment recovery outreach as an opportunity to strengthen customer relationships and build trust. Customer engagement should be seen as a collaborative effort between the business and the customer to solve the problem and ensure the continued delivery of a great product or service.

An active recovery process exemplifies how to deliver a positive customer recovery experience when customer involvement is necessary. Powered by an AI engine trained in behavioral science and psychology, an active recovery process automatically creates a positive, collaborative experience through multiple touch points, optimizing both recovery rates and customer satisfaction.

The Modern Payments Tech Stack

The modern three-tier payment tech stack incorporates a payment authorization management solution, effectively bridging the gap left by failed payments.

This modern approach builds on the traditional architecture of billing/CRM systems and payment gateways. By integrating a failed payment recovery solution, businesses can recover all types of failed payments, deliver exceptional customer experiences, and minimize the churn caused by payment friction.

The good news for subscription businesses is that solutions are available to upgrade their payments tech stack, address failed payment issues, and provide the ideal customer experience for all types of payment failures.

Building In-House Recovery Solutions vs. Integrating Specialized Solutions

Subscription businesses face a choice: develop their own in-house recovery solutions or leverage specialized solutions designed to address failed payment issues. Each business must make this decision based on its specific needs, but the following factors should be considered:

The sheer complexity of failed payments, with billions of potential scenarios, demands advanced technology and specialized expertise to achieve optimal recovery rates.

Basic recovery methods, like automated retry systems, can inadvertently harm the health of merchant accounts. There is a direct negative impact between the frequency of retry attempts and how payment authorization systems view the merchant account. Increased retry attempts can lead to a higher likelihood of future payment declines, exacerbating the issue.

Maintaining in-house recovery teams to handle failed payments is costly and requires specialized training to ensure effective customer engagement during recovery processes. Unfortunately, customer outreach through collections or customer support often results in poor recovery experiences, leading to negative moments of truth and high rates of customer churn.

Research shows that up to 48% of subscription churn is due to failed payments, not because customers voluntarily cancel their subscriptions. This data underscores the critical link between failed payments and subscription churn.

While your primary focus is on delivering excellent products or services and enhancing customer satisfaction, addressing complex payment issues is both costly and outside the core competencies of most subscription businesses.

Conclusion

Subscription businesses must put as much thought and care into delivering a great customer experience as they do into creating a great product or service. A significant part of providing an excellent customer experience is ensuring a smooth, frictionless payment process. However, legacy tech stacks often encounter issues when a payment fails. To prevent customer churn, businesses must resolve failed payments without involving the customer whenever possible. When customer involvement is necessary, companies should approach the situation positively and collaboratively. Fortunately, payment recovery solutions integrate seamlessly into existing CRM/billing systems and payment gateways, enabling subscription businesses to recover all types of failed payments and deliver the ideal customer experience.

A Complete AI-Powered Platform

Our team's AI-Powered platform maximizes revenue recovery, delivers the longest retention rates following recovery, and achieves the highest customer lifetime value (LTV).

Is your business experiencing failed recurring payments? Contact us today to explore solutions that will recover up to 80% of your failed recurring payments, increasing your cash flow, customer retention, and profitability.

Your blog is a beacon of light in the often murky waters of online content. Your thoughtful analysis and insightful commentary never fail to leave a lasting impression. Keep up the amazing work!

Thanks Harry, greatly appreciated! What grabbed your attention?