In the world of subscription and recurring billing models, businesses thrive by delivering high-quality products, flexible payment options, and seamless customer experiences. However, the success of these businesses heavily relies on a reliable payments system that can handle the submission, authorization, and acceptance of legitimate transactions. When the payments system falters, it can lead to significant customer churn, particularly through failed payments—a challenge that many businesses overlook.

Understanding the Impact of Failed Payments on Customer Churn

In subscription-based businesses, customer retention is a critical metric for sustained revenue growth and profitability. Companies invest heavily in strategies to minimize churn, as longer customer tenures directly enhance customer lifetime value (LTV). While many causes of customer churn are well-known—such as customer fatigue, competitive loss, and service issues—there’s another, less recognized factor that plays a substantial role: involuntary churn due to failed payments.

Voluntary vs. Involuntary Churn:

- Voluntary Churn: This occurs when customers proactively cancel their subscriptions due to dissatisfaction, better offers from competitors, or negative brand experiences.

- Involuntary Churn: This occurs when customers are lost not by choice but because of payment failures, often without the customer even being aware of the issue.

What Are Failed Payments and What Causes Them?

Failed payments happen when a credit card transaction is declined by the issuing bank’s payment authorization system. While it’s crucial to decline fraudulent transactions, a large portion of payment failures—67% according to Mastercard—are false declines. These occur when legitimate transactions are incorrectly flagged and declined by the system, even though the customer has sufficient credit and the intention to pay.

False declines are particularly detrimental in the subscription business model, where the average failed payment rate stands at 24%, the highest among all types of commerce. This problem is exacerbated by the growing efforts of banks to mitigate fraud, leading to overly cautious authorization systems that often decline legitimate transactions.

The Link Between Failed Payments and Customer Churn

Unrecovered failed payments are a direct cause of customer churn, but what’s often overlooked is that certain recovery methods can inadvertently contribute to even more churn. Research reveals that up to 48% of subscription customer churn is due to failed payments, rather than customers actively choosing to cancel their subscriptions. This highlights the importance of understanding and addressing the root causes of failed payments.

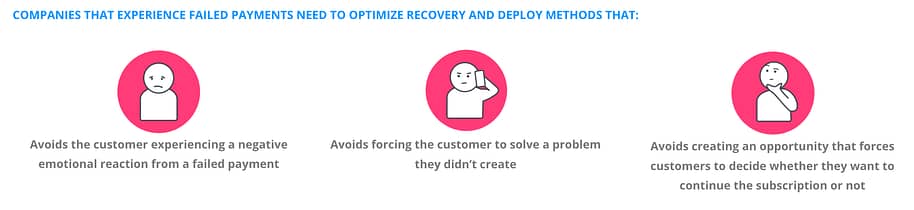

Customer Visibility and Its Role in Churn: Engaging customers in the recovery of failed payments can lead to negative outcomes. When customers become aware of a payment failure—whether through service interruptions, customer service outreach, or dunning methods—it can trigger an emotional response. This reaction might range from annoyance to embarrassment, and in some cases, customers may interpret the issue as a reflection of their financial reliability. This negative experience can tarnish the brand’s reputation in the customer’s eyes, leading to a higher likelihood of subscription cancellation.

Why Avoiding Customer Visibility in Recovery Is Essential

To minimize churn, businesses should aim to recover failed payments without involving the customer whenever possible. When customers are drawn into the recovery process, they’re forced to actively decide whether to continue their subscription or let it lapse. This decision point is risky, especially for customers who are already on the fence about the value of the service. In fact, a PYMNTS survey found that 27% of customers who became aware of a failed payment actively canceled their subscription as a result, and 38% of those who were undecided used the failed payment as an opportunity to end their subscription.

Effective Methods for Recovering Failed Payments

There are various strategies businesses can employ to recover failed payments, but the method chosen can significantly impact customer retention. Recovery methods that involve customer visibility—such as direct outreach via phone, SMS, or email—can increase the risk of churn. Recognizing that each failed payment represents not just the loss of a single billing cycle but the potential loss of an entire customer, it’s crucial to employ recovery solutions that minimize customer involvement.

Technology Solutions: There are AI-powered groundbreaking solutions designed to recover failed payments without customer visibility. By avoiding direct customer engagement, the solution reduces indirect churn and significantly improves recovery rates—by up to 70% compared to other methods. This solution works independently within existing payment systems, optimizing recovery attempts across various payment authorization rules and strategies, which are crucial given the diversity of issuing banks in North America.

Is AI-Powered Technology the Ultimate Solution?

While AI-Powered solutions should be the first line of defense in recovering failed payments, it’s not the only tool in a business’s arsenal. There are certain situations, such as when a card is reported lost or stolen, where customer involvement is necessary to resolve the payment issue. In these cases, businesses should implement customer engagement recovery methods, but only after technology solutions have been attempted. This approach maximizes recovery rates while minimizing the risk of customer churn.

AI-POWERED TECHNOLOGY SOLUTIONS TYPICALLY IMPROVES RECOVERY RATES BY UP TO

70%

VERSUS OTHER RECOVERY METHODS

Conclusion: Prioritizing the Right Recovery Strategy

For subscription-based businesses, the key to reducing churn and maximizing revenue lies in deploying the most effective payment recovery strategies. By prioritizing AI-Powered technology solutions, which operates behind the scenes without involving the customer, businesses can recover lost revenue without increasing the risk of customer defection. Only when invisible methods are unsuccessful should businesses resort to customer engagement, ensuring that every possible avenue for recovery is explored while maintaining a positive customer experience.

Is your business experiencing failed recurring payments? Contact us today to explore solutions that will recover up to 80% of your failed recurring payments, increasing your cash flow and profitability.