Introduction

Is your subscription business performing at its best? If you’re operating like the majority, there’s likely untapped potential. The key to unlocking this lies in one powerful metric: Lifetime Value (LTV).

Understanding and applying LTV in your subscription business is crucial if you aim to rise to the top. However, many businesses overlook this metric, leaving them far behind the leaders who have mastered it. This article will guide you on how to use LTV as a strategic tool to propel your company to new heights.

The Importance of LTV in Subscription Businesses

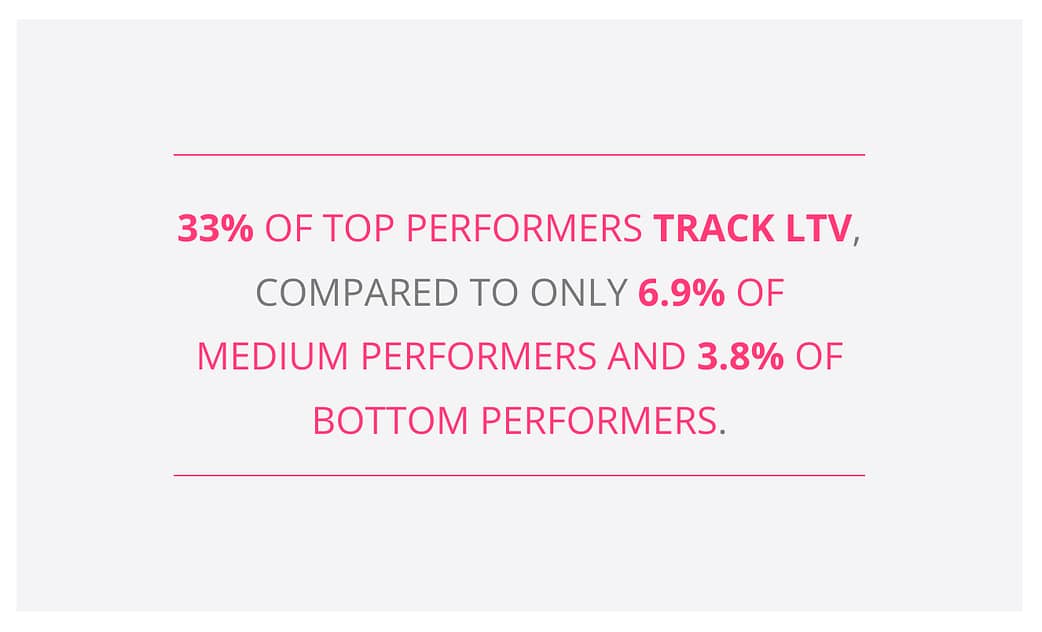

The modern subscription business landscape is competitive, and the highest-performing companies distinguish themselves by effectively managing and optimizing customer LTV. According to The State of Subscription Business: Best Practices and Business Performance Drivers, LTV is a key differentiator between top-performing companies and the rest. Yet, despite its importance, only a small fraction of companies actively measure and manage LTV.

Key Insights from the Report

One striking finding from the report is that only 8.5% of subscription companies track LTV. However, among top performers, this figure jumps to 33%, compared to just 6.9% of medium performers and a mere 3.8% of bottom performers. This means that a company that measures LTV is 8.8 times more likely to be a top performer than a bottom performer.

So why aren’t more companies measuring LTV? The most common reason is the lack of a standardized definition. Without clear parameters, it’s challenging to measure and leverage LTV effectively.

Calculating LTV: A Proven Formula

To unlock the full potential of LTV, you need a reliable calculation method such as the following formula:

This equation factors in the number of billing cycles a customer is active (which equates to total revenue from each customer), multiplies this by the gross margin after removing the cost to deliver the product or service (order value – COGS), and subtracts the customer acquisition cost.

This formula provides valuable insights into your most profitable customers by factoring in the total revenue from each customer, subtracting the cost of delivering the product or service, and accounting for the cost of acquiring new customers.

But calculating LTV is just the beginning. To truly benefit, this information needs to be shared across your organization, with initiatives aimed at improving retention and other key variables. Assigning accountability to teams for driving these improvements is also essential.

Why LTV Matters

LTV is critical because it directly influences your company’s revenue, growth, and profitability. For instance, LTV highlights the importance of customer retention, showing that the longer a customer stays, the more profitable they become. Typically, it takes 3-6 billing cycles to recoup the cost of acquiring a new customer. If a customer churns before this, they are unprofitable.

Conversely, customers who remain active beyond this point generate higher profit margins in subsequent billing cycles, underscoring the need to focus on retention.

Enhancing Retention: The Role of Involuntary Churn

The quickest way to improve retention is by addressing involuntary churn, which occurs when customers leave due to failed payments rather than a conscious decision to cancel. Our team’s data reveals that up to 48% of all churn is involuntary. Recovering these failed payments can significantly boost retention and reduce churn.

Top-performing companies are four times more likely to measure and manage failed payments than their lower-performing counterparts. This proactive approach contributes to higher LTV and overall business success.

Taking Action: Three Strategies to Boost LTV

Once you’ve calculated your LTV, you can implement strategies to improve it:

- Optimize Failed Payment Recovery: Utilize advanced recovery techniques to minimize lost revenue.

- Maximize Retention Post-Recovery: Focus on keeping customers who have been recovered from failed payments.

- Protect Merchant Account Health: Ensure that your payment processes are robust and sustainable to avoid issues that could harm your business.

These strategies, particularly those aimed at increasing retention, will have the most significant impact on your LTV and overall business performance.

Implementing LTV in Practice

The most successful companies don’t just calculate LTV; they apply it in innovative ways. For example, top performers are 12 times more likely to use third-party failed payment recovery software and 6 times more likely to measure the LTV of recovered customers. This comprehensive approach maximizes the value of each customer and drives superior financial results.

Conclusion

Measuring and managing LTV is not just a best practice—it’s a necessity for any subscription business aiming to reach the top. By understanding and applying the principles of LTV, you can unlock new opportunities for revenue growth, improve customer retention, and boost profitability.

For the vast majority of companies not currently measuring LTV, the path to improved performance starts with these three steps:

- LTV Measurement

- LTV Management

- LTV Accountability

Begin today, and you’ll be well on your way to becoming a top performer in your industry.

Is your business experiencing failed recurring payments? Contact us today to explore solutions that will recover up to 80% of your failed recurring payments, increasing your cash flow and profitability.