INTRODUCTION

Subscription businesses, ranging from monthly box services to SaaS providers, thrive on the dependable revenue that recurring subscriptions deliver. The cornerstone of these business models is customer retention, which is essential for driving both revenue and profits. The logic is straightforward: before a customer becomes profitable, the initial customer acquisition costs must be recouped. These acquisition costs, often equivalent to the revenue generated over four to eight billing cycles, typically represent the most significant expense for subscription businesses.

Despite the critical role customer retention plays in subscription-based businesses, there is no universally adopted metric to track how retention rates directly influence profitability. This isn't to say that retention metrics and reporting aren't valued within these businesses, but traditional income statements don't account for the direct impact of retention efforts on profitability. Conversely, they also don't reveal the financial burden caused by increased customer churn.

This article explores the difficulties CFOs encounter when attempting to quantify the financial benefits of improved retention rates through the income statement. Additionally, it introduces a new metric designed to bridge the gap between retention and profitability reporting, thereby enhancing financial decision-making in subscription-based businesses.

Evaluating Retention in the Income Statement

Consider a hypothetical pet food subscription box company named Doggy Bits. While this example centers on a subscription box model, the approach can be applied to any recurring billing service, such as streaming platforms or SaaS providers.

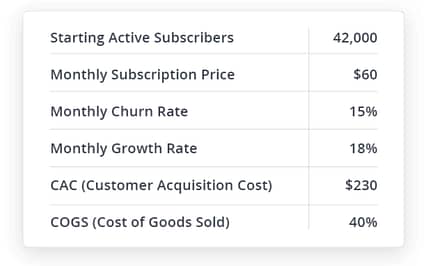

Below are Doggy Bits’ operating statistics for the first month under review.

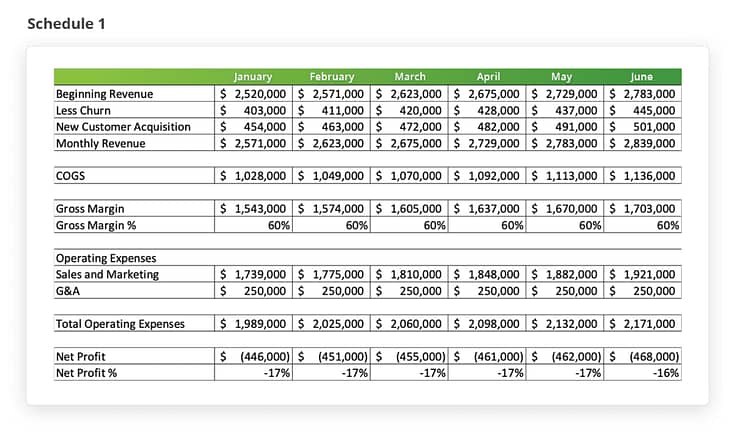

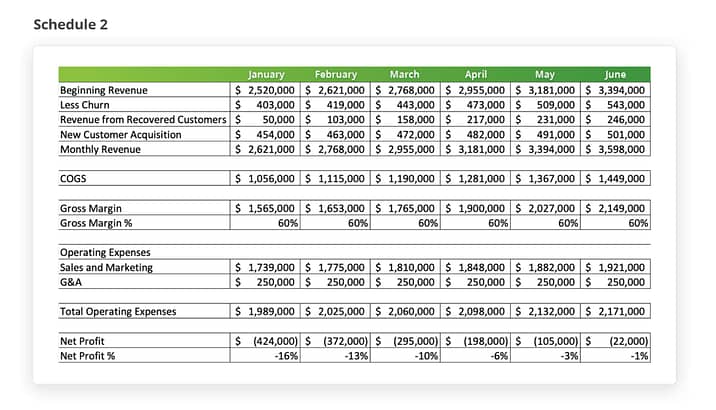

To clarify revenue sources, the pro forma income statement details the monthly revenue components, including starting revenue, revenue lost to churn, and revenue gained through new customer acquisition.

Although Doggy Bits is acquiring more customers than it is losing to churn, the company continues to operate at a monthly loss due to overhead expenses and customer acquisition costs.

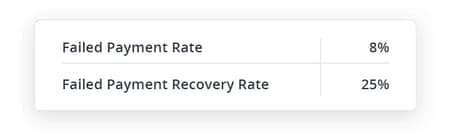

The company experiences a churn rate of 16% per month, with half of this churn resulting from unrecovered failed payments, rather than customers voluntarily ending their subscriptions. "Failed payments" refer to instances when a customer's credit card is declined, leading to involuntary churn if the payment isn’t recovered.

To combat this, Doggy Bits implements a solution that recovers 25% of these failed payments, thereby saving these customers from involuntary churn. On average, these recovered customers remain active for an additional four billing cycles post-recovery.

Now, let’s assess the impact on the P&L when churn is reduced by recovering 25% of failed payments. Since failed payments account for 50% of Doggy Bits' total churn, this recovery reduces the monthly churn rate from 16% to 14%. While this may seem like a modest reduction, the resulting increase in revenue and profitability is substantial.

For clarity, the revenue generated from recovered customers who continue billing for an additional four months post-recovery is highlighted as a separate line item, “Revenue from Recovered Customers.” Typically, this would be included in the top-line revenue.

Is it reasonable to expect four additional months of billing from recovered customers? While results will vary by company, based on their specific customer base and product or service, four months is a reasonable average. Some companies see recovered customers billing for over 10 months, while others see just two additional payments, making it crucial to measure this metric accurately.

You’ll notice that revenue from recovered customers grows rapidly until it levels off in May. This plateau occurs when customers recovered in January reach the end of their four-month lifespan, halting the compounded growth from each subsequent month’s billing.

Key Changes in Doggy Bits' Financial Performance

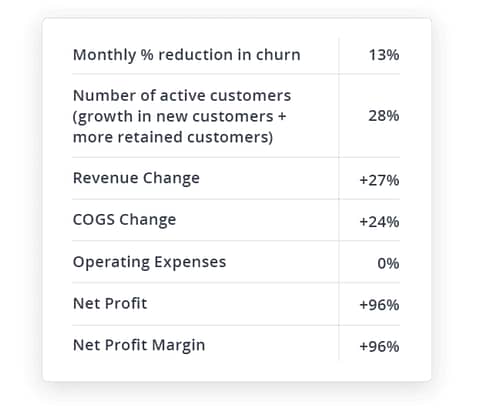

Let’s examine the key changes in Doggy Bits' results in June, comparing the reduction in churn to the forecasted results in Schedule 1, where no payment recovery solution is implemented.

This example clearly illustrates the concept of profit leverage through customer retention: a small increase in retention yields a disproportionately large gain in revenue and profitability. Enhanced retention boosts profits without raising customer acquisition or fixed costs. While a company may choose to reinvest these profits into new initiatives, such as increasing general and administrative expenses or expanding customer acquisition efforts, these decisions stem from increased profitability rather than expenses incurred directly by improved retention.

Notably, without a payment recovery solution to enhance customer retention, Doggy Bits incurs a 15% net operating loss in June. However, with a solution that improves retention by just 13%, the company nearly breaks even in June. Extending the forecast over 12 months, this 13% retention improvement leads to an 8% net profit margin, compared to a 14% loss without the retention gain.

Incorporating Subscriber Retention into the P&L

Doggy Bits’ P&L reflects a significant positive impact on operating profit due to increased customer retention. Yet, despite retention being a key driver of financial health for subscription businesses, there’s no standard operating metric that tracks the relationship between retention and profit margin or identifies the source of improved profits on the income statement.

Introducing a New Subscription Operating Metric

To address this, we propose a new metric: Net Income Per Customer (NIPC). The NIPC formula is simple: Net Profit Dollars / Number of Active Customers.

NIPC offers several key benefits:

- It measures how much profit each active customer contributes.

- It highlights the profit gains from improved retention without significant changes in fixed costs.

- It provides a benchmarking tool for companies in the same industry, particularly in comparing retention-driven profitability.

While variable expenses like COGS and acquisition costs influence net profits, other factors may also impact NIPC. However, by focusing solely on NIPC, businesses can track the direct impact of customer retention on net profits.

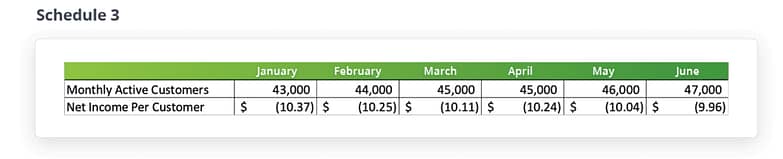

Let’s revisit Doggy Bits to see how NIPC helps identify how the company generates more revenue from customers without additional acquisition costs. Schedule 3 shows Doggy Bits’ monthly NIPC without any improvement in customer retention.

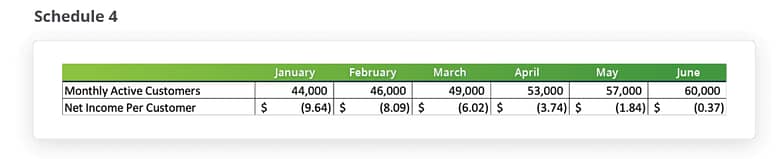

Schedule 4 illustrates Doggy Bits’ monthly NIPC with a 13% improvement in customer retention.

The retention improvement begins in month one, but as the number of actively billing customers grows, the gap in net income per customer widens. As previously noted, this increase in net income is due to the higher profitability of retained customers compared to the revenue generated from acquiring new ones.

The financial leverage gained from customer retention results in a 28% increase in monthly active customers and a 96% increase in NIPC. The NIPC metric clearly shows how Doggy Bits achieved the net profit gains over 12 months as previously analyzed.

Conclusion

Until now, subscription-based businesses have lacked a metric to directly measure the impact of customer retention on net profits. NIPC fills this gap by clearly linking retention to profitability and offering a straightforward comparison of retention efficiency across similar companies.

The NIPC metric reveals that even small improvements in customer retention — such as recovering customers lost to involuntary churn — can lead to significant net profit growth. Therefore, investing in retention-enhancing technology, like a payment recovery solution, should be a top priority for every subscription business, given the clear financial benefits. The data speaks for itself.

Is your business experiencing failed recurring payments? Contact us today to explore solutions that will recover up to 80% of your failed recurring payments, increasing your cash flow and profitability.