Recovery of Failed Payments

A Proven Solution For Businesses With Recurring Transactions

- Reduce Customer Turnover

- Increase Revenue

- Decrease Collections Expense

- Maximize Customer Lifetime Value

THE DECLINE PROBLEM

2/3

Up to 2/3 of CNP (Card Not Present) declines are false positives - these should have been accepted. Much of the remaining declines are for NSF (Non Sufficient Funds).

48%

48% of all customer churn is due to failed (declined) payments.

27%

27% of customers actively canceled their service as a result of awareness of a failed payment, along with a 20-25 point NPS (National Payment System) decrease and a hit to the company’s reputation.

Keep Your Customers Current

The longer the failed payment situation lingers,

the bigger the problem becomes,

the greater the probability of a negative impact on your bottom line.

The single biggest cause of customer churn in subscription businesses are failed payments, and the strategies you implement to recover those failed payments matter. Research shows that customer visibility to the failed payment created through service interruptions and dunning approaches are also drivers of churn. By employing our solution, you can recover the declined transaction without involving your customer and therefore reducing churn.

FREE NSF RECOVERY

CASHFLOW TECHNOLOGY

BENEFITS

Clear Recovery For Up To 80% Of Your Declined Recurring Payments

First, Fast, and Free

Try This Solution for Failed Payment Recovery

As a business receives declined or NSF payments, a great amount of money is spent on recovery or the loss.

Traditional mode of recovery includes calling the customer to fix the declined payment. Some customers will cancel on the call (about 1 out of 7). A Collection Agency means the customer is lost forever, while the Agency keeps up 50% of collected funds on a 20% rate of recovery over 60 to 90 days. Not only do you lose a customer, but now you have a new expense of replacing lost customer. Sales and boarding can be very expensive.

Before You Attempt To Clear Your Failed Payments...

Try This Solution To Clear Recover And Deposit At No Cost

Failed payments are normal and costly, but our solution eliminates declined payments and the high cost of recovery.

What is most important to you and your business:

No Set Up Fees, No Monthly Fees, And No Equipment To Buy.

Clear Recover up to 80% of your recurring returned or declined ACH, eCheck, Debit or Credit Card transactions.

Experience

Our network has saved millions of dollars in collection for over 14,000 Clients over 22-years, is an Associate Member of the NACHA (National Automated Clearing House Association) and Associate Member of the ACA (American Creditors Association).

What Type Of Businesses Use Our Services?

Recurring billers of all types...

CASE STUDY

Hospital, Medical Center, Pharmacies, and Clinics

Situation

Critical Issue/Pain

Solution

Benefits

Results

No Risk

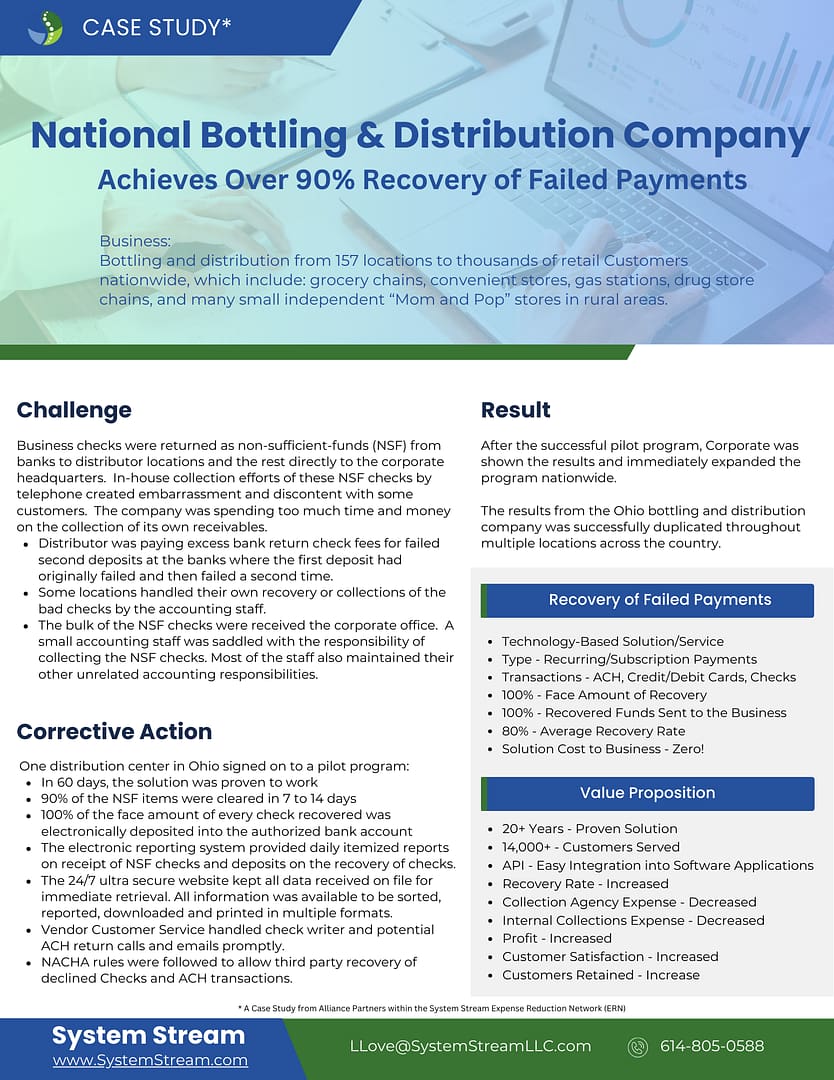

CASE STUDY

National Bottling and Distribution Company

F.A.Q.

How May We Help You?