INTRODUCTION

The subscription industry is currently navigating significant challenges as the economic landscape differs markedly from year to year. The rapid growth of subscription services and SaaS solutions that thrived during the pandemic has slowed. With inflation driving up costs, consumers cut back on new subscriptions and canceled existing ones they consider non-essential. Compounding these challenges, businesses themselves grappled with rising operational costs due to inflation.

This shift is impacting subscription businesses across the spectrum, from small startups to industry leaders. Even major players like Netflix have reported declining subscriber growth and increased customer churn. For example, Netflix anticipated gaining 2.5 million new subscribers in Q1 2022 but instead saw a loss of 200,000 subscribers, with a further 2 million expected to churn after that.

While the current business environment presents new challenges, it also offers opportunities for businesses to achieve lasting operational efficiencies through strategic investments in technology and other key areas.

Economic data suggests that companies investing strategically in new technologies to enhance operational efficiency and improve customer experiences will outperform their competitors in growth and profitability during economic downturns and in the recovery phase that follows.

Understanding the nuances of customer churn is especially critical during periods of economic uncertainty. Unfortunately, many subscription businesses lack a comprehensive understanding of the various sources of churn and, as a result, do not address them as distinct issues requiring targeted solutions. It is crucial for subscription businesses to identify and manage all sources of customer churn to mitigate its financial impact.

Customer retention and churn rates are fundamental metrics that every subscription business strives to optimize. Enhancing customer retention boosts LTV, directly contributing to revenue and profitability growth. Given the high cost of acquiring subscription customers (often exceeding 2.5 months of billing cycles), long customer lifecycles are necessary for businesses to recoup acquisition costs and establish profitable relationships.

This article aims to help subscription businesses understand all sources of customer churn and offers recommendations for investing in payment technology upgrades to reduce a significant source of churn, thereby improving both short-term revenue and long-term LTV.

A CLOSER LOOK AT CHURN

Customer losses can be categorized into two types: voluntary churn and involuntary churn. It’s essential for subscription businesses to distinguish between these types, measure them separately, and optimize strategies and technologies to minimize both.

VOLUNTARY CHURN

Occurs when customers actively choose to cancel their subscriptions. Many subscription businesses mistakenly believe that most or all churn is voluntary and focus their resources on enhancing the customer experience to reduce churn. Unfortunately, voluntary churn is accelerating due to external factors beyond the control of businesses. According to the Subscription Commerce Conversion Index (a collaboration between PYMNTS and sticky.io), approximately 46 million consumers voluntarily canceled or paused retail subscriptions by March 2022. Inflation was a significant driver, with 54% of consumers who canceled subscriptions citing cost-saving as their primary reason.

INVOLUNTARY CHURN

Happens when payment-related issues prevent legitimate recurring payments from being processed successfully. Involuntary churn represents a substantial portion of overall churn and is primarily caused by failed payments (also known as declined credit card transactions). Visa reports that two-thirds of failed payments result from false declines—instances where legitimate credit cards are incorrectly declined. This issue disproportionately impacts subscription businesses, with an average of 24% of recurring payment requests being declined.

It’s important to note that while failed payments can contribute to voluntary churn, the majority of involuntary churn occurs without the customer actively choosing to end the subscription relationship.

HOW TO REDUCE INVOLUNTARY CHURN

Despite the rising rates of voluntary churn due to current economic conditions, there is a significant opportunity for subscription businesses to reduce involuntary churn, which is not directly tied to the economy. Better yet, involuntary churn can be effectively minimized through strategic technology investments that address the root causes of the problem.

Developing a Deeper Understanding of Involuntary Churn

Subscription businesses should start by separately tracking voluntary and involuntary churn. When calculating the total cost of involuntary churn, it’s important to measure the total LTV of customers lost due to involuntary churn, rather than just the value of the single missed transaction. By understanding the full LTV impact of customers lost to involuntary churn, companies can build a strong business case for investing in payment technology upgrades to address the issue. The immediate and long-term gains from reducing involuntary churn and enhancing customer LTV underscore the value of such investments.

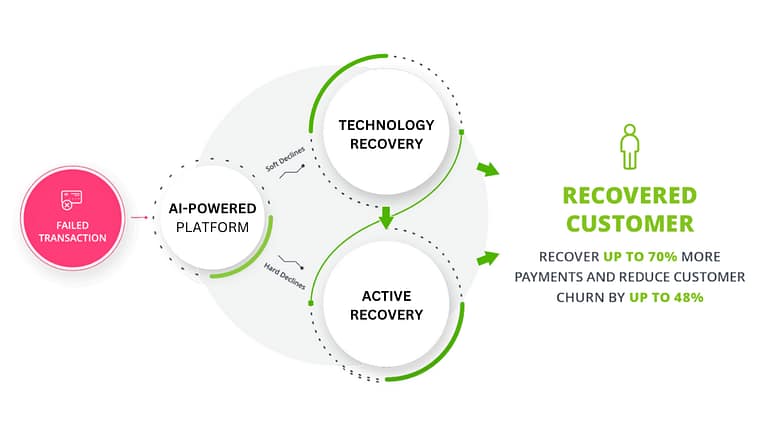

Data indicates that involuntary churn accounts for up to 48% of all customer churn. According to Visa, up to 67% of failed payments (which drive involuntary churn) are due to false declines or incorrect card authorization declines on valid cards. The link between failed payments and involuntary churn is clear—any failed payment that isn’t recovered results in a churned customer, as the active subscription cannot continue.

Many businesses do not realize they are able to recover up to 70% of declined transactions leveraging specific recovery solutions. Considering that up to 48% of churn is driven by failed payments, it’s easy to see how much churn can be reduced and how much additional revenue can be generated over the lifetime of each recovered customer by implementing recovery solutions.

GETTING STARTED

Four Steps for Subscription Businesses to Measure and Address the Impact of Involuntary Churn

- Calculate your historical and current involuntary churn rates, as well as the percentage of churn caused by failed payments. This will give you a clear picture of the initial revenue lost due to failed payments.

- Invest strategically in your payment technology stack by integrating a failed payment recovery solution.

- Track the revenue recovered in the first month after implementing the solution, along with the total lifecycle value of customers who are successfully recovered. This will provide an accurate measure of the value of a recovered customer.

- Assess the cost-effectiveness of your failed payment recovery solution by comparing its cost to the total LTV of customers following recovery.

SUMMARY

As inflation continues and consumer spending tightens, many are facing financial strain, leading to increased subscription cancellations. While voluntary churn may be difficult to control, subscription businesses have the power to significantly reduce involuntary churn by strategically investing in technology that enhances their payment infrastructure. Utilizing a failed payment recovery solution can reduce churn, boost revenue, and increase customer LTV.

A Complete Recovery Solution

Leveraging an AI-powered solution optimizes revenue recovery, ensures the longest retention periods post-recovery, and maximizes customer LTV.

Is your business experiencing failed recurring payments? Contact us today to explore solutions that will recover up to 70-80% of your failed recurring payments, increasing your cash flow, customer retention, and profitability.