Introduction

In the subscription economy, building lasting customer relationships is paramount. The longer customers stay, the more they contribute to a company’s revenue and profitability, forming the backbone of success in this business model.

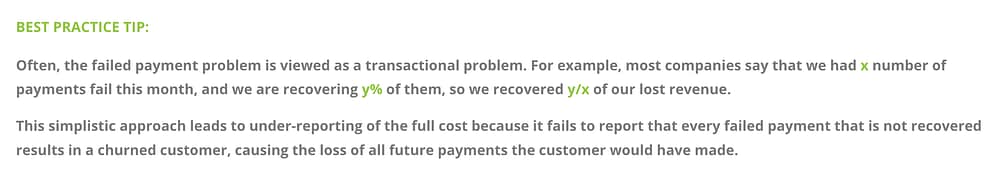

While most subscription companies understand the reasons behind customer churn and focus on minimizing it, many overlook a significant contributor: involuntary churn. This type of churn, driven by failed payments, can account for nearly half of all lost customers.

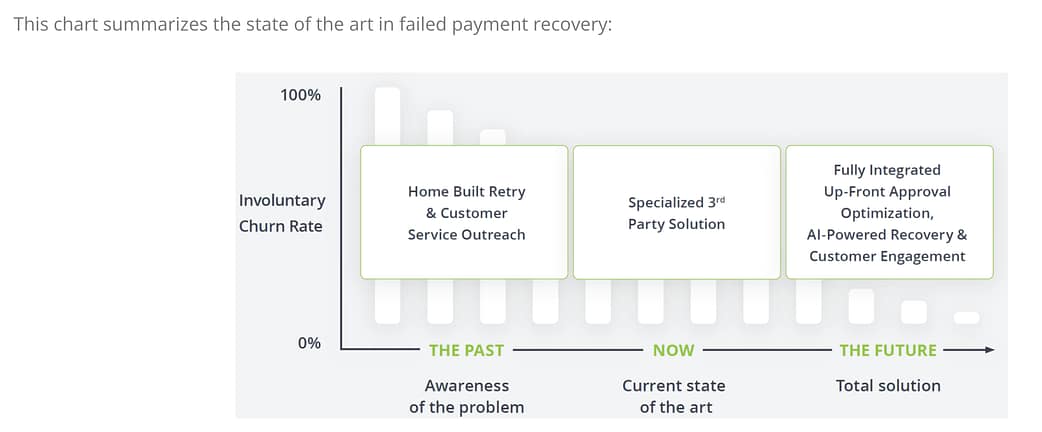

Increasingly, businesses are waking up to the impact of this issue and are implementing systems designed to recover these missed payments.

From Awareness to Excellence

We applaud those companies that have identified the problem of failed payments and begun efforts to reclaim them. Initial in-house solutions often recover 15%-25% of failed payments—a respectable start. However, there’s potential for much more.

According to a 2023 report, companies achieving the best financial outcomes have fine-tuned their approach to payment recovery and customer retention post-recovery. The highest performers recovered as much as 59% of failed payments by leveraging the right mix of people, processes, and technology. The message is clear: there is always room to improve failed payment recovery, which can elevate a company’s financial performance from good to great.

What It Means to Go from Good to Great

The link between failed payments and churn is a critical indicator of how improved payment recovery can transform financial outcomes.

Failed payments impact every subscription business to some extent, but those that excel in recovering these payments tend to see outsized financial gains. Understanding this can unlock tremendous potential.

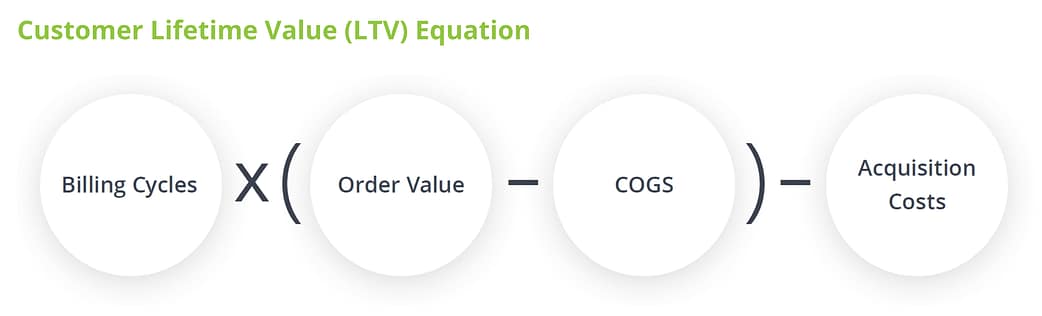

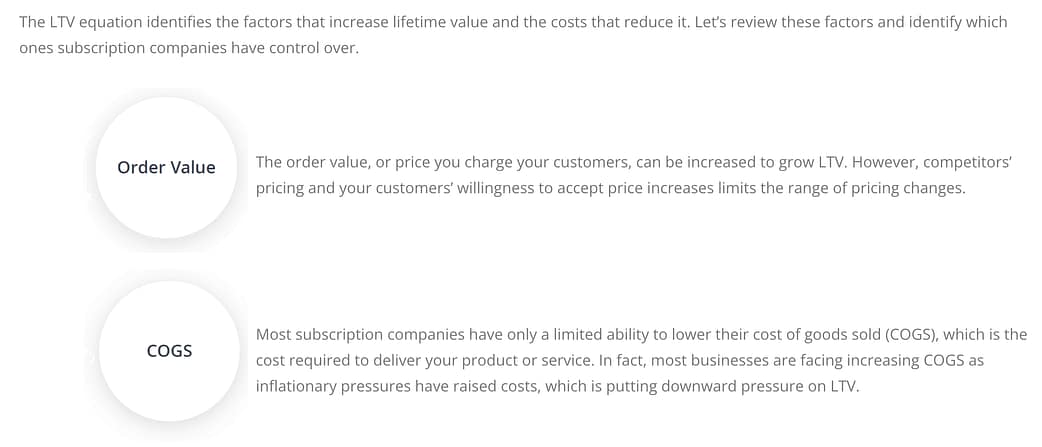

A key tool in this process is the equation for calculating Customer Lifetime Value (LTV). This formula helps businesses gauge the total LTV of their customer base, as well as individual customer LTVs. It also provides insights into what drives LTV and, ultimately, overall financial performance.

Our team advocates for every subscription company to implement this calculation and maintain current LTV values for each customer. This practice offers powerful insights into which acquisition channels are most profitable, which retention strategies yield the most returns, and other operational optimizations.

Reducing involuntary churn has a compounding positive effect on LTV and revenue, as recovered customers continue making payments that would have been lost otherwise. Additionally, the revenue from these recovered customers typically has higher profit margins compared to new customer acquisition, which often involves significant costs.

Achieving high-margin revenue is a key goal for subscription companies because it fuels reinvestment, growth, and competitive advantage. Top-performing companies recover an average of 59% of their failed payments, demonstrating what it means to transition from good to great.

By unlocking the hidden revenue and profits already within your business through improved failed payment recovery, you can secure a significant lead over your competition.

Maximizing LTV with Advanced Payment Recovery Solutions

As many companies have recognized the issue of failed payments, they’ve often turned to homegrown solutions to address it. However, our research shows that the highest-performing subscription companies rely on specialized, purpose-built payment recovery solutions. In fact, top performers are 12.3 times more likely to use third-party solutions compared to their lower-performing counterparts. These top-tier companies often complement these solutions with additional methods, starting with the most effective tools to optimize recovery and retention from the outset.

Cutting-Edge Payment Recovery: Maximizing Lifetime Revenue and Profitability

The leading subscription companies recover an average of 59% of their failed payments, setting the standard for state-of-the-art recovery outcomes. This benchmark can help other companies gauge their own performance and explore opportunities to increase customer recovery, thereby driving LTV and profit growth.

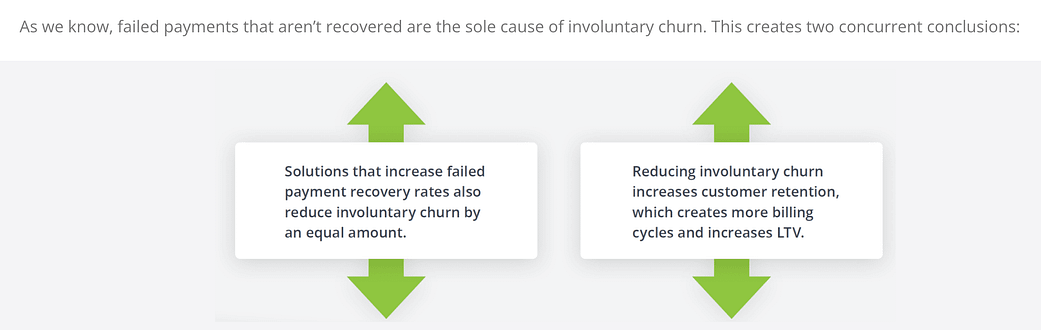

While each company’s results will vary, our team has consistently delivered substantial improvements when clients switch from internal recovery solutions to our specialized AI-driven system. Typically, companies that make our team's solution the cornerstone of their recovery process see significant gains.

Cutting-Edge Recovery Solutions: Boosting Revenue and Profits

Traditional first-generation solutions—often built in-house—rely on rule-based payment retries and customer service outreach. However, today’s best-performing companies use second-generation solutions. These advanced systems are purpose-built to optimize payment recovery and are crucial to achieving recovery rates of 59%. Our team's approach includes:

- Technology Solution: This method operates directly within the payment system to recover failed transactions swiftly and discreetly, enhancing retention by minimizing customer disruption. Powered by AI and machine learning trained on over 6 billion payment transactions, our team's technology solution is a cornerstone for the success of many subscription businesses.

- Active Solution: When customer involvement is necessary, this approach fosters collaboration, transforming the recovery process into a partnership that helps resolve issues effectively.

Looking ahead, third-generation solutions will combine upfront approval optimization to reduce the incidence of failed payments with advanced recovery technologies, further enhancing performance.

Conclusion

Companies that have started addressing failed payments with first-generation solutions have taken a crucial step, but there’s more potential to be realized.

Beyond immediate revenue boosts, improving payment recovery enhances long-term revenue growth, profit margins, and overall company valuations.

Top subscription companies understand the power of investing in cutting-edge payment recovery solutions to boost customer retention and LTV.

For instance, one of our team's clients, a public company, saw over $2.5 million in recovered revenue in Q4 2022 alone. During the same period, their quarterly net income was just under $1.8 million. The revenue recovered by our team not only turned a quarterly loss into a profit but also significantly improved the company’s stock price and valuation.

By upgrading your payment recovery strategy, you can unlock significant revenue potential and propel your subscription business from good to great.

Is your business experiencing failed recurring payments? Contact us today to explore solutions that will recover up to 80% of your failed recurring payments, increasing your cash flow and profitability.