Customer retention and lifetime value (LTV) are vital metrics for subscription businesses, as they have a direct influence on both revenue growth and overall profitability. To minimize churn and maximize the length of customer relationships, these businesses dedicate significant resources to ensuring customer satisfaction and delivering exceptional experiences.

The primary factors driving customer churn are well-known:

In the competitive world of subscription businesses, reducing customer churn is essential to sustaining growth and profitability. While the common drivers of churn are widely acknowledged, there’s a lesser-known factor that significantly impacts customer retention.

Key Causes of Customer Churn:

- Customer Fatigue:

Customers may lose interest or no longer see value in the product or service they’re subscribing to, leading them to cancel. - Competitive Loss:

When customers find a better or more cost-effective alternative, they often switch to a competitor, resulting in churn. - Customer Service Issues:

Poor customer service experiences can drive customers away, prompting them to cancel their subscriptions.

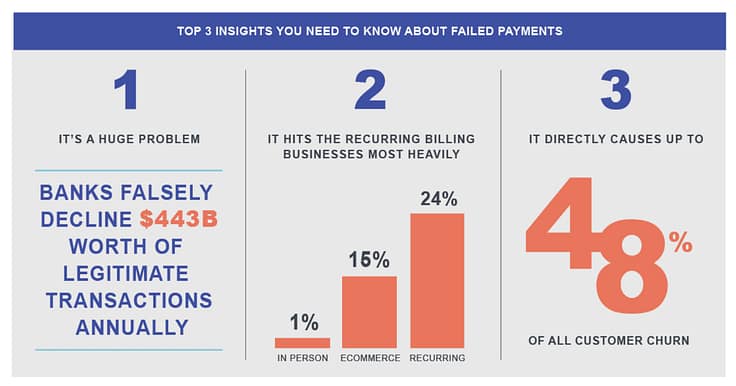

However, there's a crucial but often overlooked factor contributing to customer churn—payment authorization errors. Shockingly, up to 48% of customer churn in subscription businesses is due to failed payment transactions. This issue is frequently under-managed, despite its significant impact on retention.

Bridging the Churn Gap

The connection between payment authorization failures and customer churn is not immediately obvious, but it is a critical issue for eCommerce and subscription-based companies. Research highlights that nearly half of all churn is related to declined transactions, not because customers actively choose to cancel their services.

This finding raises two important questions for subscription businesses:

- What is causing payment authorization errors?

- How can these errors be minimized to reduce customer churn?

Strategic Solutions:

A new category of financial technology, Payment Authorization Management (PAM), offers innovative solutions aimed at reducing payment failures and the associated churn. Here's a brief overview of PAM best practices:

Invisible Solutions:

PAM solutions operate behind the scenes, preventing negative customer experiences and resolving payment issues without requiring customer involvement.AI and Machine Learning:

These technologies enable the creation of personalized payment strategies, optimizing authorization accuracy and improving settlement outcomes.Advanced Algorithms:

PAM solutions use sophisticated algorithms, trained on massive datasets, to enhance the accuracy of payment authorizations.Deep Industry Knowledge:

Algorithms embedded with comprehensive payment ecosystem knowledge are key to improving authorization results.Cloud-Based Integration:

PAM systems are typically cloud-based, with broad API integration capabilities, allowing seamless connection with payment gateways and CRM/billing systems.

“eCommerce and recurring billing based businesses must adopt a payment authorization management strategy to avoid up to 48% of customer churn”

AI-Powered Technology Solutions

AI-Powered technology solutions are a leading player in the PAM space, offering several benefits:

- AI-Driven Recovery:

AI technology tailors recovery strategies for each failed payment, resulting in a 75% increase in recovered transactions. - Minimized Churn:

By swiftly resolving payment failures, the solution reduces churn caused by service interruptions, averaging just 2.9 days to recover lost payments. - Customer-Friendly:

The invisible recovery process eliminates the need for customer intervention, avoiding churn caused by traditional dunning methods. - Enhanced Customer Lifetime Value (LTV):

Businesses using an AI-powered technology solution typically experience more than 2.6 additional successful billing cycles after recovery, significantly boosting customer LTV. - Risk-Free Implementation:

The AI-powered technology solution operates on a performance-based pricing model, meaning businesses are only billed based on actual recovery success, with no upfront implementation fees.

Conclusion

For any subscription or recurring billing business, recognizing and addressing payment authorization errors is crucial to reducing customer churn. Implementing a robust Payment Authorization Management (PAM) strategy can optimize payment authorizations, reduce churn related to failed payments, and ultimately drive business growth. Adopting an AI-powered technology solution can be a game-changer in maintaining customer loyalty and maximizing revenue.

Is your business experiencing failed recurring payments? Contact us today to explore solutions that will recover up to 80% of your failed recurring payments, increasing your cash flow and profitability.