INTRODUCTION

Imagine you’re in the world of The Matrix, and Morpheus is offering you a choice between two pills. Take the blue pill, and you’ll continue believing that your payment systems are working just fine. Take the red pill, and you’ll uncover the truth: the subscription industry is grappling with an issue that’s artificially limiting revenue and customer retention.

Which would you choose?

While The Matrix is fictional, the subscription industry does face a hidden problem that contributes to nearly half of the churn businesses experience. Solving this issue can unlock the potential to reduce customer churn by up to 50% and increase your revenue by more than 20% in just 12 months. The best part? This revenue growth doesn’t require additional customer acquisition spending, which means it contributes directly to your bottom line.

But here’s the most critical part: this problem is universal, affecting every subscription company and creating a status quo that caps revenue, customer lifetime value (LTV), and profitability far below their true potential.

As more companies uncover this secret, the industry will shift. Businesses that quickly adopt a solution to this problem will gain a significant edge over their competitors, not just in revenue and profitability, but in market share as well. This article will guide you on how to achieve this competitive advantage.

Unlocking the Opportunity (Phase 1)

Step 1:

To secure and sustain your competitive advantage, start by tracking and reporting failed payments, and assess their impact on your business.

Begin with a straightforward calculation: the short-term cost of failed payments. This provides a limited view but is an essential starting point.

Calculating Short-Term Costs:

- Add up the total dollar value of monthly customer card authorization requests that are declined and unresolved.

- This calculation shows the immediate revenue loss due to failed payments.

Step 2:

Next, determine the true cost of failed payments by considering the long-term impact on customer LTV.

The full cost of unresolved failed payments stems from the lost LTV of customers who churn due to these failures, a phenomenon known as involuntary churn. Involuntary churn can account for up to 50% of your total churn.

Calculating True Costs of Involuntary Churn

- Calculate your Average Customer Lifespan (the average number of billing cycles before a customer churns).

- Determine the lost billing months due to involuntary churn.

- Multiply the Customer Order Value by the number of lost billing months to find the total lost LTV per customer due to failed payments.

- Sum the lost LTV of all customers with unresolved failed payments to measure the total revenue lost from involuntary churn.

This calculation will reveal the potential revenue recovery by addressing failed payments. Remember, each failed payment doesn’t just represent a single lost billing cycle—it impacts the entire lifespan of that customer.

Simply implementing a failed payment recovery solution isn’t enough; you must also optimize customer retention post-recovery to maximize LTV and drive substantial revenue growth.

Step 3:

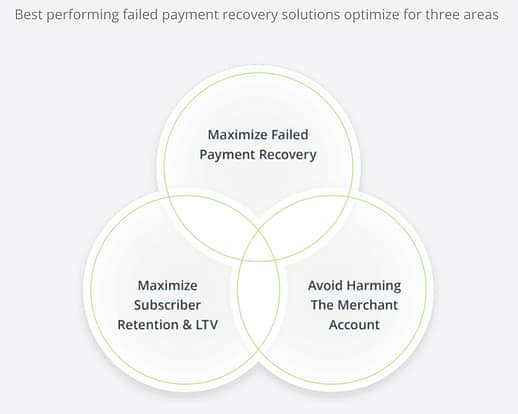

Choose and deploy a failed payment recovery solution that achieves these three crucial outcomes:

- Optimized failed payment recovery.

- Maximized customer retention after recovery.

- Protection of your merchant account’s health.

Understanding the underlying issue is vital when selecting the right solution.

Failed payments often result from authorization decision errors, where legitimate cards are mistakenly flagged as fraudulent by banks. Visa has reported that up to 24% of recurring billing transactions face such declines. While the rate varies by company, this issue impacts every subscription business. Importantly, these customers are not bad credit risks—they are victims of a flawed system. Therefore, how you handle these failed payments is critical to retaining these customers.

Automatically directing customers with failed payments to collections or dunning processes can damage customer relationships. Such approaches may not reach every customer, create negative experiences, and increase the likelihood of customers walking away.

Failed Payment Recovery Best Practices

To achieve optimal results, focus on these best practices:

- Choose a solution that uses multiple recovery techniques tailored to different types of failed payments.

- Whenever possible, resolve payments directly within the payment system to avoid alerting customers, which could lead to indirect churn.

- Leverage advanced technology, such as AI, to develop individualized recovery strategies based on the specific reasons for a card decline.

- When engaging with customers, create a positive and empathetic experience that fosters partnership, ensuring their subscription service isn’t disrupted.

- Avoid solutions that rely on brute-force retry attempts:

- Excessive retries increase your merchant account’s risk score, which can lead to higher decline rates.

- New penalties from Mastercard and Visa in 2023 penalize excessive retries, leading to increased costs for merchants.

- Internally developed rules-based retry systems often underperform compared to sophisticated, purpose-built technologies and may exacerbate the problem.

Deploying the right failed payment recovery solution will immediately reduce failed payments and decrease overall customer churn by reducing involuntary churn.

A Powerful Growth Driver

Another significant benefit of failed payment recovery is the compounding financial effect. A properly recovered customer will continue to generate revenue for their full lifespan following recovery. Each month of retained revenue contributes to growing your profits, similar to how compound interest works. This continuous revenue and profit growth fundamentally elevates your company’s financial performance, opening up new opportunities.

When this happens, the barrier that once suppressed your revenue and profits is shattered.

Your business now enjoys a higher customer LTV, improved cash flow, and increased profitability—since the recovered revenue doesn’t require new acquisition spending. As you know, customer acquisition is typically one of the largest costs for subscription businesses, making this recovered revenue essentially free money for your business.

Unlocking the Opportunity (Phase 2)

Companies that are early adopters of failed payment recovery solutions will enjoy these financial benefits before their competitors catch up. Reducing involuntary churn before your competition gives you a strategic advantage to capture and sustain market share for years to come.

Deploy a failed payment solution now to start reducing involuntary churn immediately. This will allow you to reinvest the growing revenue and profits into strategies that further enhance your competitive edge.

Strategic Investment Opportunities

- Increased Acquisition Budgets: Reinvesting new profits into customer acquisition will accelerate growth. Additionally, improved customer LTV and profitability will open new customer cohorts that were previously unprofitable.

- Enhanced Product and Service Experience: Investing in better experiences benefits all customers, not just those who experience failed payments. This leads to higher overall customer satisfaction, retention, and LTV, creating a positive feedback loop that further drives revenue and profitability.

Conclusion

Implementing a failed payment recovery solution that significantly reduces involuntary churn is the key to gaining a lasting competitive edge. Early adopters who understand the strategic importance of solving this issue also realize that speed is crucial. The faster you implement a failed payment recovery solution, the greater the competitive advantage you’ll gain. With this approach, you could see a revenue increase of over 20% within 12 months. The opportunity is here now—don’t let it slip away.

Is your business experiencing failed recurring payments? Contact us today to explore solutions that will recover up to 80% of your failed recurring payments, increasing your cash flow and profitability.