INTRODUCTION

In the competitive world of subscription-based businesses, customer churn is one of the most significant challenges to sustained growth. However, viewing payment recovery not merely as a way to retrieve lost transactions but as a strategic opportunity to recover and retain customers can fundamentally transform a business’s growth trajectory. This shift in mindset emphasizes the long-term value of each recovered customer, considering the cumulative impact of future payments over the lifetime of their subscription.

Maximizing customer tenure is directly linked to increased revenue growth and enhanced profitability. Therefore, it is crucial for subscription businesses to identify and effectively manage the various factors contributing to customer churn. By doing so, companies can significantly improve key performance indicators (KPIs), driving overall business success.

THE IMPACT OF CUSTOMER RETENTION ON REVENUE GROWTH

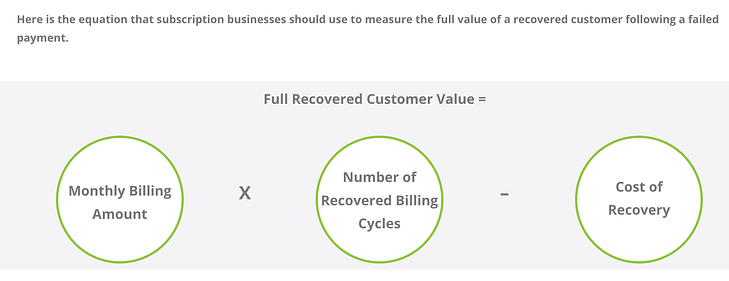

Recovered customers represent a vital, ongoing revenue stream for subscription businesses. They contribute additional billing cycles, which in turn fuels the overall growth of active customer numbers and total company revenue. What’s more, these benefits can be achieved without additional expenditure on customer acquisition—a cost that typically represents one of the largest financial burdens for subscription-based companies. Indeed, few investments offer a better return or faster acceleration of subscription revenue growth than implementing an effective failed payment recovery solution.

A DETAILED EXAMPLE

To illustrate this concept, consider a hypothetical subscription business with the following metrics:

- Active Customer Accounts: 50,000

- Average Customer Monthly Billing: $50

- Monthly Growth Rate: 15%

- Failed Payment Rate: 13%

- In-House Payment Recovery Rate: 20% (using customer service or basic dunning)

- Average Customer Lifecycle: 8 months

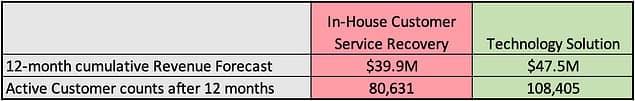

Now, imagine deploying a high-performance failed payment recovery solution. Let’s explore the impact of such a solution on active customer counts and revenue growth within the first year, compared to a traditional in-house recovery program that relies on dunning or rules-based methods.

PROJECTED OUTCOMES

By implementing a high-performance failed payment recovery solution, the business could experience the following outcomes in just 12 months:

- Increase in Annual Revenue: A projected rise of 19%

- Growth in Active Customer Count: An increase of 34%

These figures demonstrate how significantly revenue growth can accelerate when the number of active customers expands through more effective recovery of failed payments. The financial gains are substantial, underscoring the critical role that advanced payment recovery solutions play in driving long-term business success.

THE BROADER IMPLICATIONS OF PAYMENT RECOVERY

The true economic value of recovering failed payments lies not just in the immediate transaction, but in the long-term revenue generated by retaining a customer over their entire lifecycle. When businesses recognize this extended value, it becomes evident that optimizing payment recovery is not merely an operational necessity—it is a strategic imperative.

Effective failed payment recovery solutions do more than just recoup lost revenue; they help sustain customer relationships, extending the duration of subscriptions and maximizing lifetime customer value. By focusing on methods that optimize recovery rates while also enhancing the customer lifecycle post-recovery, businesses can secure a stable and growing revenue base.

CONCLUSION

In conclusion, the most effective way for subscription businesses to accelerate growth is by focusing on customer retention through sophisticated payment recovery strategies. By shifting the perspective from merely recovering transactions to recovering and nurturing customer relationships, businesses can unlock significant long-term revenue potential.

Prioritizing failed payment recovery is not just about recapturing lost dollars—it’s about recapturing and retaining customers who will continue to contribute to your business’s revenue stream for months or even years to come. By investing in advanced, AI-driven recovery solutions, subscription businesses can effectively minimize churn, maximize customer lifetime value, and drive sustained revenue growth well into the future.

Is your business experiencing failed recurring payments? Contact us today to explore solutions that will recover up to 80% of your failed recurring payments, increasing your cash flow and profitability.